Nifty

Nifty is trading in a broader range daily moving 100 to 210 points. Giving good opportunity to traders. Today one of my friend said he is pity on those who do not use SLs in their trade. Yes, if at all they take counter trend trades without SL, we have to be pity on them. India VIX is hovering above 25 and Nifty is trading in a good range where traders can use the opportunity to make good money. Earlier we posted on Nifty with different time frames of

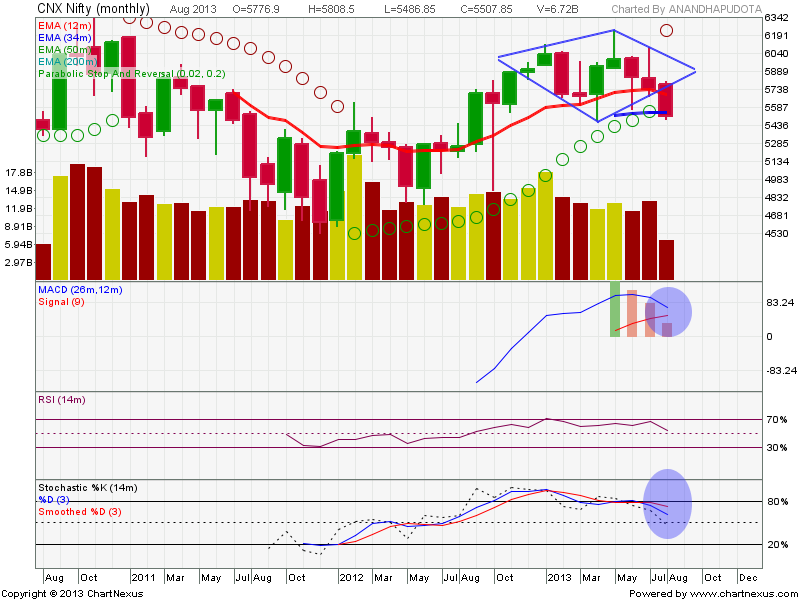

1. Monthly Diamond Break down bearish pattern

2. Pitch Fork target prices.

In earlier down move, all price target range were met during those time frames. Even in this pull back till yesterday morning first few minutes, we were given target using Expanding triangle pattern when it broke up the channel in which it was travelling earlier. Below are few charts which I was sharing with my near and pear group.

Now I relabeled all EW counts and feel there is more down side in Nifty. Nifty is forming a very rare formation that is triangle formation in 2nd wave of Impulsive 3rd wave C. This formation is very rare in technical EW. Refer the NCNIFTY_EW_Alternative.

Refer the link here. [Although upon extremely rare occasions a second wave in an impulse appears to take the form of a triangle, triangles nearly always occur in positions prior to the final actionary wave in the pattern of one larger degree]

Here is the current view of the Nifty with clear labeling. We will see the Nifty move from here on follow strictly. Looking at the current momentum in Nifty it looks it resumed its impulsive nature with its down trend and moving downwards. If that is correct we consider todays fall as impulsive move (iii) rd wave of 3rd wave of C after completion of rare formation expanding triangle of (ii) wave of 3rd of C.

Tomorrows follow up actions and further moves of nifty have to confirm this from here on.

Andrew Pitch Fork:

Looking into the swing moves on Nifty 4 hour charts, Nifty clearly failed to hit the targets of pull back for the swing 6093 to 5118 levels at around 5635 levels which is a clear sign of bearishness. Earlier also we posted analysis on Nifty with Pitch Fork lines where it failed upside which pulled down the nifty drastically.

Looking into current swing from 5118 to 5580.95 and looking at the targets as per Andrew Pitch Fork lines, targets are falling at below 5175 levels. If EW labeling show above is correct then these targets are easily attainable.

If we look at the supports that Pitch Fork lines can give are the line of the previous Pitch Fork lines which are falling at around 5233.Moving below these lines may warning signal for further correction.

Looking at EMAs.

As expected 34 EMA resisted the move of Nifty and we saw a correction of more than 200 points with Market depth of 250 points. At some point we felt that 12 EMA may give support. But Nifty decided to see lower levels it seems so it could not wait in that range corrected sharply with good volumes. Due the recent rally all indicators are adjusted so that they can provide enough space for Nifty to see more lower levels.

Todays close also below the DLwEMA which signifies the bearishness in the market.

Trade with support and resistance levels in mind. Keep trailing SL is your girl friend along with your fried trend. So keep doing good and happy trading day.

If any pull back seen towards 12 EMA ( for today at 5442) can be used as shorting opportunity with SL above 34 EMA.

As per PSAR on daily charts 5158 seems to be support or trend reversal point.