Nifty

Nifty Nifty Nifty... Everyone eyes on Nifty. People who are good in markets say Nifty have resistance here and support here. If moves above this Nifty visit these levels. Otherwise Big bhom. blah blah.....

People who are not good at market analysis says Market down by XX points.This week market has fallen some XXX points.

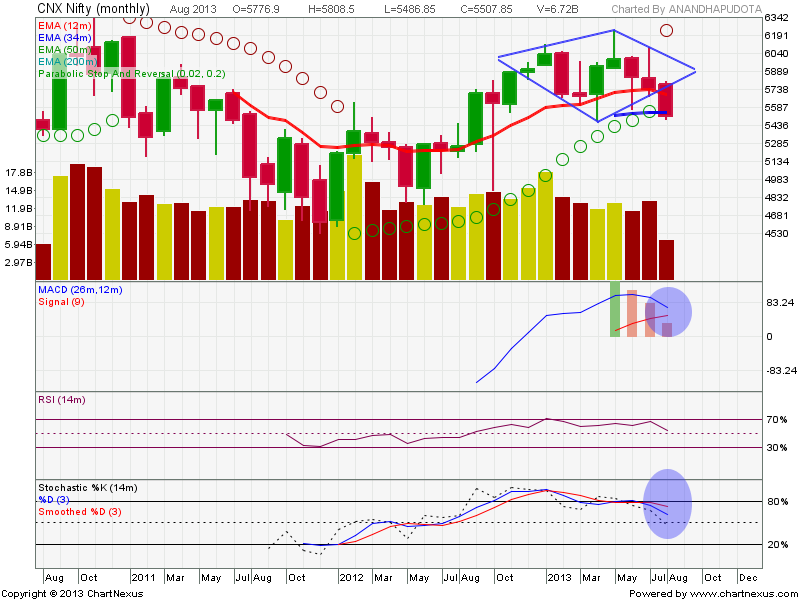

Lets see what technicals are speaking about Nifty.

Daily Chart:

Nifty daily chart shows Nifty found support at 5270 levels and bounced back. Nifty is moving in an upward channel for more than a year which is shown in RED trend lines. This channel gave support for the Nifty and Nifty moved up from the channel bottom. Nifty made a lower low by touching 5268 levels showing some weakness.

There are two downward channels in which Nifty is moving on daily charts. One( Brinjal colored channel) started at starting of the year and another(Blue channel) one started in 2 months ago. However Nifty shows that there is trend(Blue channel top) line resistance @ 5550 levels.

RSI seems to be turning down. We can not pressume anything unless price action confirms this.

If Nifty have to confirm its down trend we expect Nifty to find support at bottom of the downward channel around 5190 - 5050 levels marked with Red Circle

If the blue trend line is broken we see next resistance is coming at around 5703 levels.

Using Andrew Pitch fork on Hourly charts,(From GCI MT4 data) Considering the swing high as 5754 and low as 5246.Target would be 5476 which was achieved almost last Friday. Secondly, if we try considering the swing low as 5246 and Swing high as Fridays High 5476 then the target should be 5280.

Suppose if we consider the swing high as 6093 and swing low as 5246 and then the target for this up move would be 5704. This will be confirmed once the Nifty crosses 5550 and stays above.

Intraday chart:

Nifty is still moving in a downward channel.Channel top being around 5620 levels. Chart included Pre open data.From last two days Nifty is moving with mild bullish sentiment and moving in an upward channel. Nifty seems to be at the top end of the channel and bottom is falling around 5360 levels. After having 2 days of rally, Nifty no where giving any kind of -ve divergence to expect a fall. So Nifty may still continue upmove. But Price action anytime may move so that techncicals will adjust.

Nifty predictive move could be formation of HnS pattern. Suppose if Nifty found a resistance at 5504 levels and correct, we may see support at 5364 /5280 levels from which Nifty may bounce back to see sharp up move if at all Nifty feel like rallying. Otherwise, It may visit the bottom of the channel shown in daily charts below 5200

.

EW Lables:

Considering the EW labels. Nifty looks in 2nd wave of 3rd of C if C is in 5 wave structure. Looking for 3rd wave target at 5150 levels.2nd wave of 3rd of C almost pulled back till 1st of 3rd of C which is almost 100% if Nifty see 5504 levels. Nifty moving above this level invalidates that the Nifty is in 3rd wave of C.

EW says that there is a chance that the Nifty may visit the bottom of the downward channel around 5150 - 5005 levels.

So lets trade on Nifty holding 5400 for bullish side and breaking below 5345 bearish side.

Please note that I have been giving a warning for options traders to be cautious due to expected volatility.

Happy trading day.

.